Competitive Edge

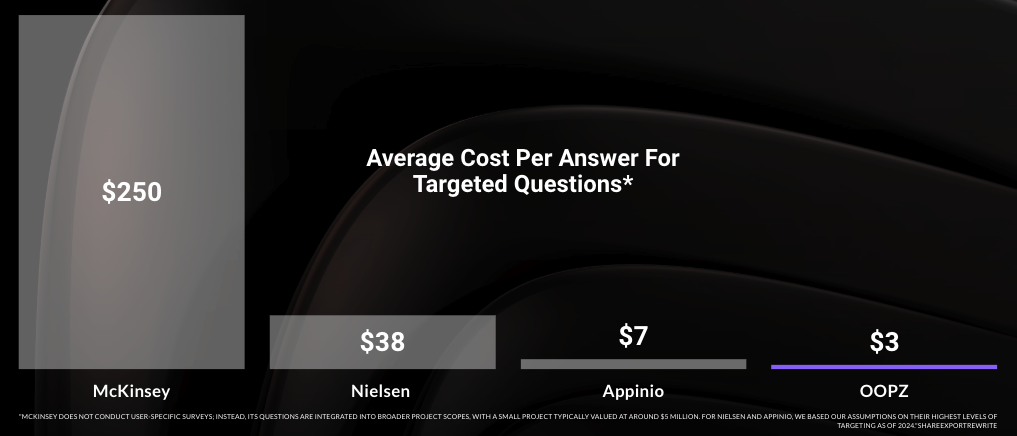

The preference market is segmented into high-end consulting firms (e.g., McKinsey), mid-tier platforms (e.g., Nielsen), and low-cost data-only providers (e.g., Appinio), creating competitive margin potential for OOPZ.

Understanding Costs

Competitor firms like McKinsey and Nielsen have higher fees because their services rely on large teams of experts, meaning clients pay for significant human time and effort. Costs also rise from sourcing and compensating specific individuals for feedback, as finding and engaging the right respondents quickly is resource-intensive.

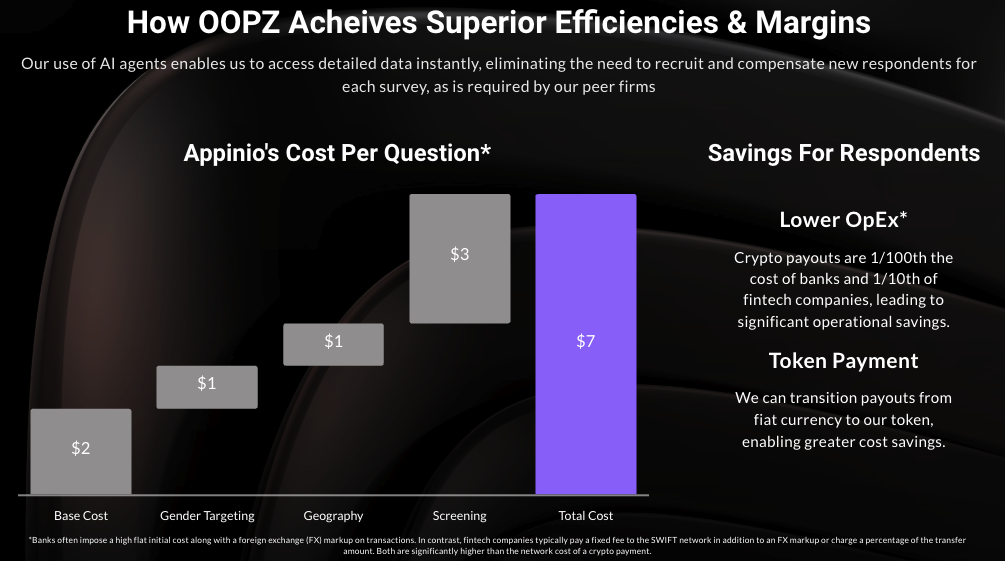

Even automated platforms like Appinio face extra expenses to keep respondents engaged and ensure quality responses, often requiring higher incentives. Below is a breakdown of the cost.